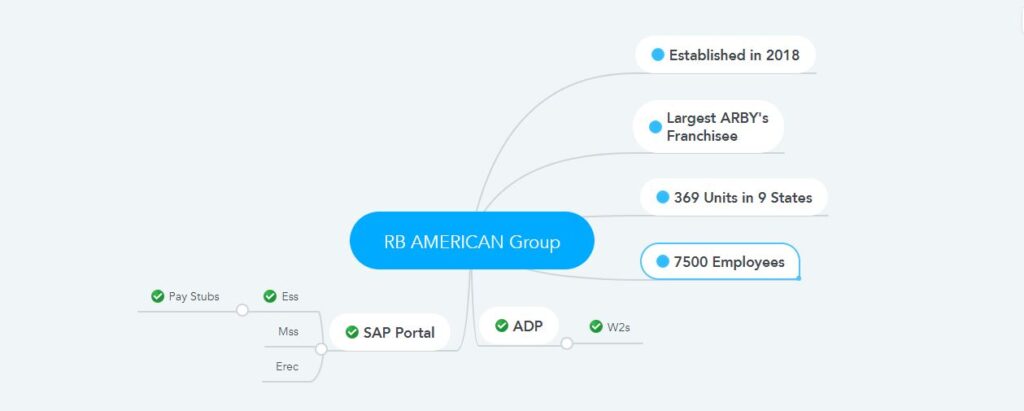

RB American Group is Arby’s largest franchisee. The company was established in 2016 by Flynn Restaurant Group. The RB American Group currently has about 369 restaurants and employs just over 8,000 people. Arby’s restaurants, run by RB American Group, exist across nine states in the United States: Arkansas, Colorado, Idaho, Illinois, Kansas, Missouri, Oklahoma, Washington, and Wyoming. However, in this currently discussed article, I will discuss how the staff of the Arab American Group will access the pay stubs and W-2 forms. So if you are an employee of the RB American Group, read the full article, and if you have any queries about payroll, you can call the Payroll Department at 855-430-7672.

How to access Pay Stub?

Employees of the RB American Group will be able to access their pay stubs from the SAP ESS portal. However, every employee must log in to the SAP ESS portal. Follow the steps below to access your pay stub by logging in to the Employee Self-Service Portal.

- First, visit the SAP Employee Self-Service Portal. The web address of SAP Employee Self-Service is https://portal.flynnrg.com/.

- Then, sign in to your ess account by entering your login ID and password. If you forget your password, click on the “Get Support” link, and you will be able to recover your password by entering your personal information.

- Click on the “Benefits and Payroll” submenu from your account dashboard. It is in the “Employee Self-Service” tab.

- Click “Earnings Statement” at the bottom of the next page. It is in the Payments section. This will show the latest pay stub on the next page. You can save your pay stub to a print or PDF file using the print or save icon.

- How to access the W-2 form?

Employees of RB American Group will access their necessary tax forms online using ADP’s services. However, every employee has to go to the ADP Self-Service Portal, complete the registration and give consent to access the W-2 form electronically. On or before January 20, the RB American Group distributed tax forms to workers online. To get the 2021 W-2 form online, you must complete the registration by December 30, 2021. Else, you will not be able to admittance the 2021 W-2 form online. However, if you have already completed the registration, i.e., have accessed the W-2 form online by 2020 or earlier, there is no need to register in a new way. Below is how to complete the registration to access the W-2 form from the ADP Self-Service Portal.

- First, visit ADP Self Service’s web portal. The web address of ADP Self Service’s web portal is my.adp.com.

- If you want to register as a new user, click the “Create Account” link at the bottom; otherwise, log in with your user ID and password. But if you forget your password or user ID, “Forgot user ID?” Click on the link to retrieve the user ID or create a new password.

- After selecting “Create Account,” you have to enter the registration code by clicking on the “I Have a Registration Code” link in this step. The ADP registration code for the Arabic American Group is APR1-TAX.

- Confirm your identity with the required information in this step and click on the “Continue” button.

- Now, complete the verification by entering your contact information like phone number, email address, etc., and click on the “Continue” button.

- In this step, you will get a system-generated user ID with @APR1 at the end. And you need to create a password; of course, follow the password guidelines to create a password and click the “Continue” button.

- Select the three security questions and answer them by clicking on the “Register Now” button.

Now login to your account again and give your consent to receive your W-2 form electronically. ADP also has a mobile application that you can use to access your W-2 form.