How to Access AlphaStaff Pay Stubs and W2s Online?

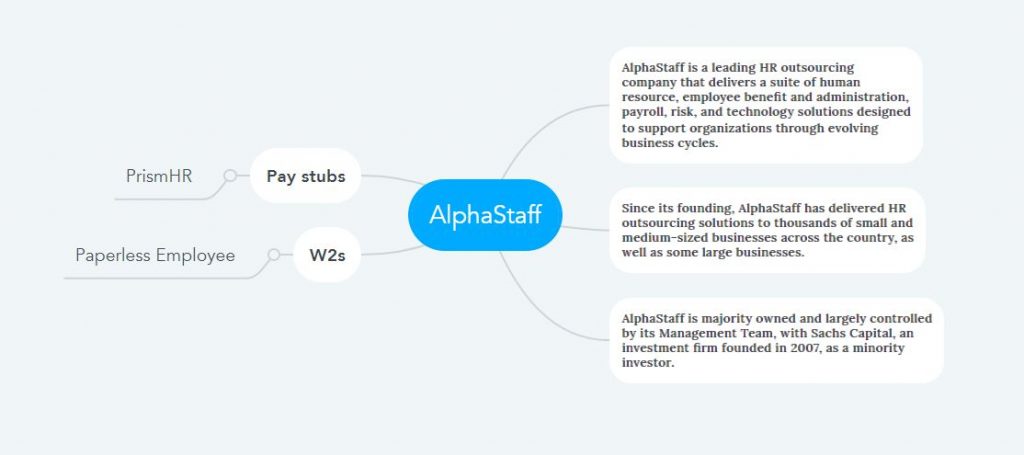

AlphaStaff is one of the leading outsourcing companies in the US Human Resource Services industry that provides various technical solutions to different companies’ HR and Payroll departments through a team of experienced experts. It simplifies business through technical knowledge, management skills, and expert vision and contributes to overall success. AlphaStaff also provides employees with the convenience of a modern and online HR portal, where they receive Pay Stubs through the PrismHR platform and year-end tax forms or W2s through the Paperless Employee portal.

AlphaStaff Pay Stubs on PrismHR Employee Self-Service Portal

- To receive or access your pay stubs in the PrismHR Employee Self-Service Portal, you must first be a registered user. So visit the portal link (https://alp-ep.prismhr.com/) without delay and start the registration process by clicking “Register.” Then enter your Name and SSN in the PrismHR registration form and select username and password as login credentials. Finally, click the “Register” button at the end of the registration form to complete the process and return to the login screen. Now, log in by providing the Username and Password you just created during the registration process.

- Upon completion of login, you will get access to the PrismHR dashboard, where you can view or download your Pay Stubs and update your personal information as needed. To check or update your home address or direct deposit information, do so by accessing the “Personal” menu.

- For Pay Stubs, you must first access the “Pay” menu. You will then see your last few pay stubs titled by date. To view the history of all your pay stubs, click on “View More” to view the entire list. Then click on the title containing any date, which will be a detailed view.

- If monthly maintenance is required on the portal, PrismHR authorities give advance notification. Then for a particular time, the features used by AlphaStaff will not be available, or access to the portal will not be possible.

- If you cannot access the portal or your account is locked, click on “Forgot Password” and provide your username. A reset link will be sent to your email to unlock your account. Moreover, you can solve any problem by calling this number (888-335-9545) or through this email (ClientTechnology@alphastaff.com).

AlphaStaff W2s on Paperless Employee Portal

- Now you need to access Paperless Employee Portal for year-end tax or W2 statements, and you also need to be a registered user. So let’s go directly to this link (https://www.paperlessemployee.com/alphastaff), click “Create Account,” and start opening the account in the registration process.

- First is the Account Authentication step, where you must provide personal information and authenticate through the “I’m not a robot” checkbox to go to the following account opening stage. Here in the Account Name option, provide the first and last name of the user and then create the username and password.

- Then comes the security questions step, where you have to save the answers to the three security questions. And in the case of Contact Information, you must provide your Primary Email Address, Optionally Alternate Email Address, and Cell Phone Number. Validation must be done by providing an email address where a validation code will be sent to your email, and it must be submitted in the “Email Validation Code” option.

- Then in the case of notification settings, the user can set up everything according to his needs and wishes, and at the end, click on “Save Notification Option Settings.” However, to receive the W2 statement electronically, you must click the “Yes” button and keep it active.

- Finally, when the W2 statement is updated, and the notification comes to your email or phone, log in to the portal and check from the “Year-End Tax Statements” option.

Disclaimer: The AlphaStaff and AlphaStaff logos are the registered trademarks and copyrighted works of AlphaStaff, Inc.